Gurgaon, a vibrant city in the National Capital Region (NCR), has evolved into a powerhouse of business, finance, and technology. This transformation has not only bolstered its economic stature but has also propelled its real estate market into prominence. As of 2024, Gurgaon offers a spectrum of residential property options catering to diverse investor preferences and financial goals. This detailed analysis delves into the current dynamics, factors influencing property prices, and strategic insights to guide prudent investment decisions.

Current Market Overview

1. Economic Landscape and Growth Prospects

Gurgaon's real estate market in 2024 reflects moderate growth projections amid economic uncertainties and regulatory changes. The city continues to attract both end-users and investors, driven by its robust infrastructure development and strategic location within the NCR.

2. Shift Towards Affordability

There is a noticeable trend towards more affordable housing segments in Gurgaon. This shift is driven by changing consumer preferences, particularly among younger demographics and first-time homebuyers who prioritize functional living spaces over extravagant amenities.

3. Infrastructure Development

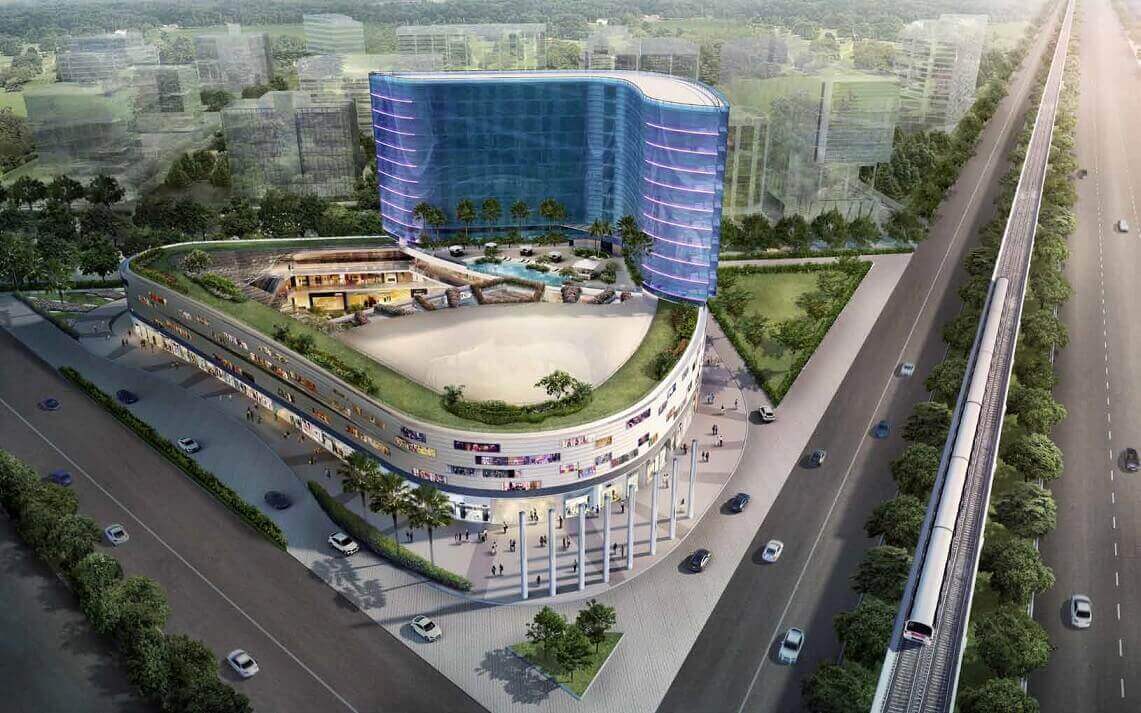

Ongoing infrastructural projects, including metro expansions, road network enhancements, and the development of commercial corridors, are pivotal factors influencing residential property prices. These initiatives are set to catalyze growth across residential, commercial, and industrial sectors in Gurgaon.

4. Embrace of Sustainable Living

The rise of eco-friendly residential properties underscores a growing preference for sustainable living among buyers and investors. Features such as energy efficiency, water conservation, and green design principles are gaining prominence, reflecting broader environmental consciousness in the market.

Factors Influencing Residential Property Prices

1. Location Dynamics

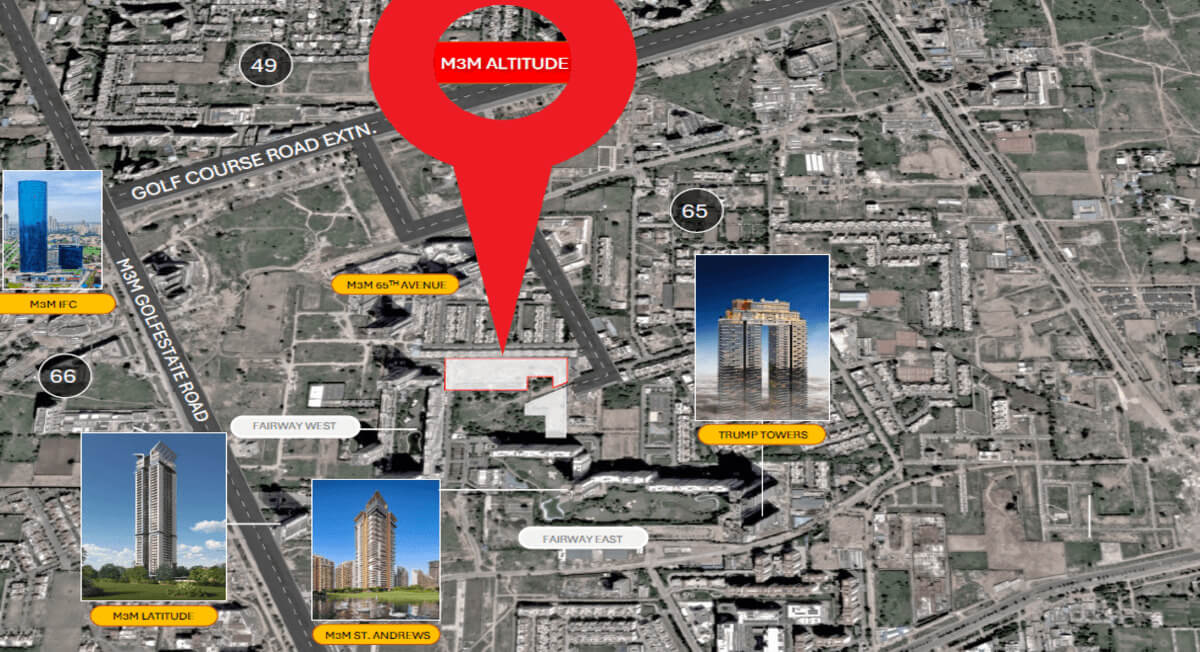

Location remains paramount in determining property prices in Gurgaon. Prime areas like Cyber City, Golf Course Road, and DLF Phase 1 command premium prices due to their proximity to business districts, entertainment hubs, and social infrastructure. Conversely, developing sectors offer more affordable options but may see significant appreciation with upcoming infrastructure projects.

2. Property Type and Configuration

Property type and size play a critical role in pricing. Luxury apartments, expansive villas, and independent builder floors typically carry higher price tags compared to compact apartments in high-rise buildings. The market also favors mid-segment properties that strike a balance between affordability and spacious living.

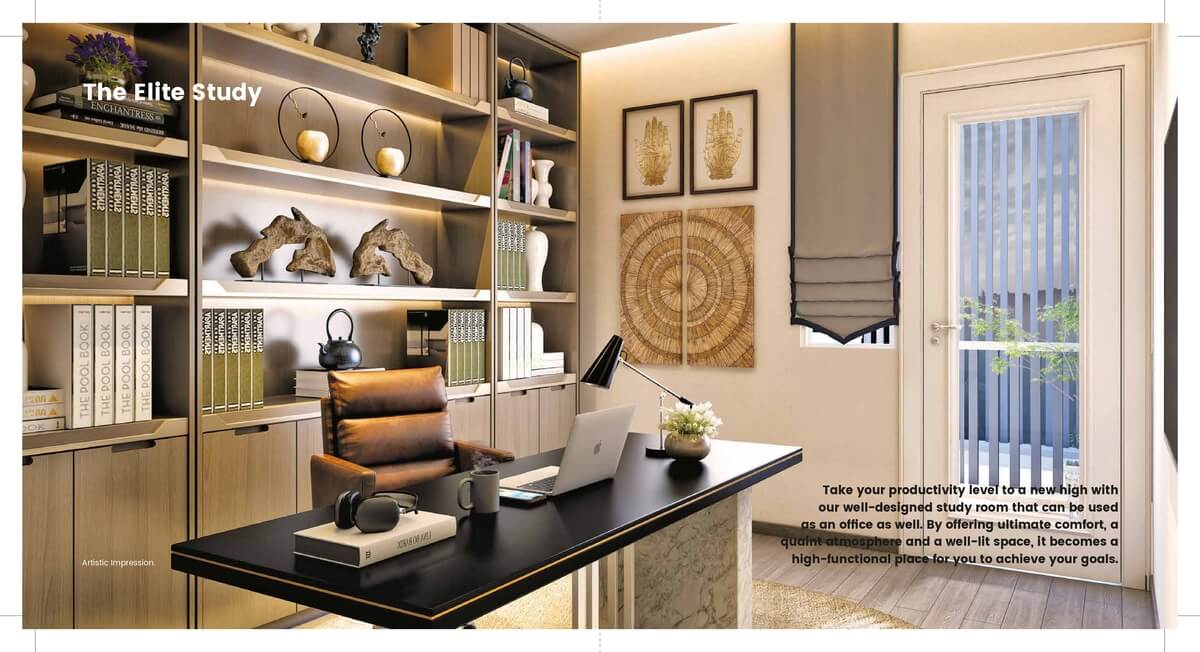

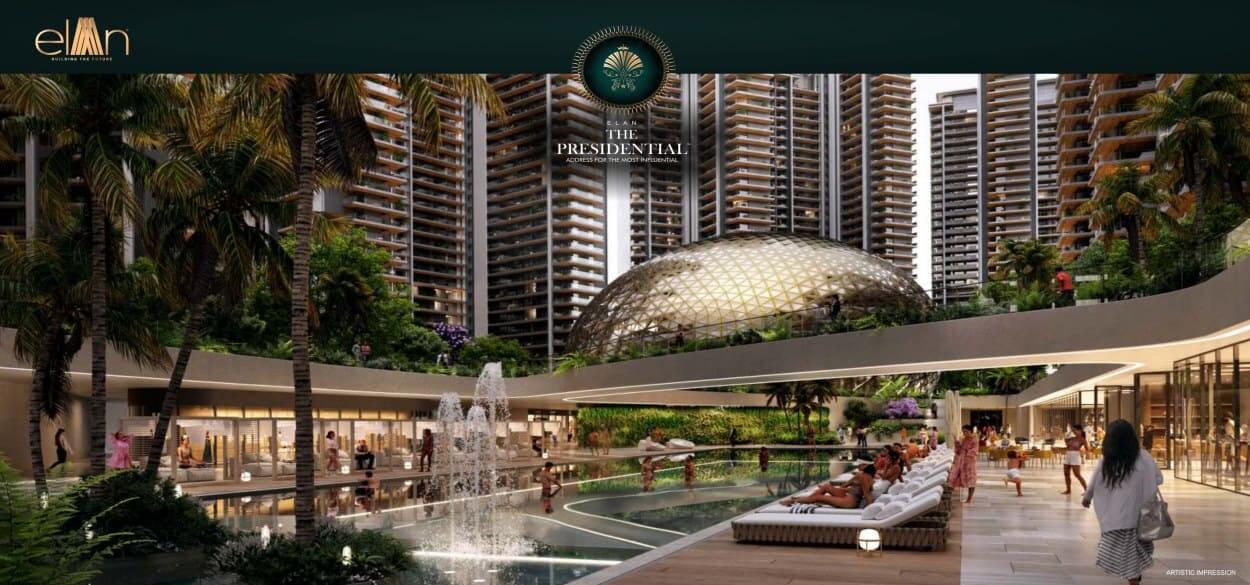

3. Influence of Amenities

The range and quality of amenities significantly impact property prices. Luxury residences often feature extensive amenities such as swimming pools, clubhouses, and concierge services, driving up their cost. In contrast, budget properties may offer more modest amenities like basic security and parking facilities.

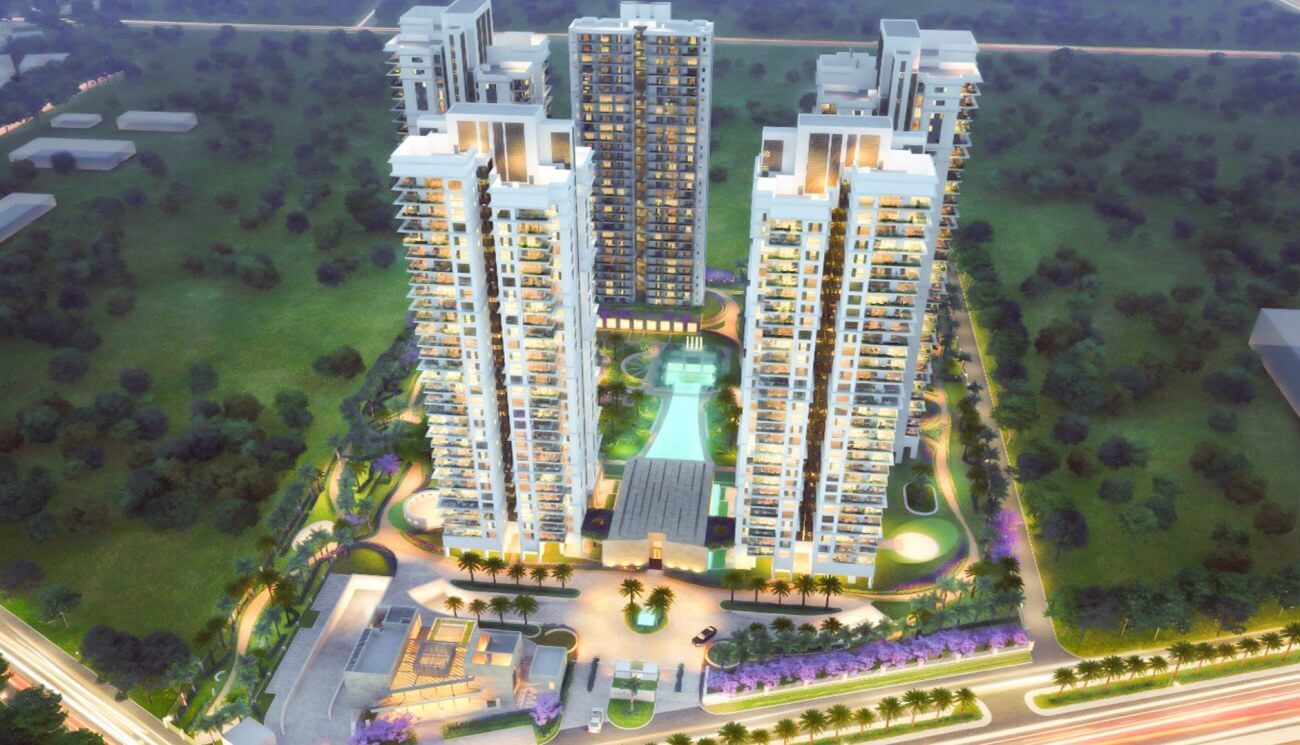

4. Construction Quality and Developer Reputation

Properties built with superior construction quality by reputable developers command higher prices and enjoy greater demand. Buyers and investors prioritize modern fittings, durability, and meticulous craftsmanship, which contribute to long-term value appreciation.

5. Supply-Demand Dynamics

The equilibrium between supply and demand is a pivotal determinant of price trends. Areas with high demand and limited supply witness accelerated price growth, whereas oversupplied markets may experience price corrections over time.

Price Trends Across Market Segments

1. Luxury Segment

Luxury properties in prime Gurgaon locations are expected to maintain stable to moderate growth in 2024. The demand for high-end residences with exclusive amenities remains robust among affluent buyers and investors seeking prestige and long-term capital appreciation.

2. Mid-Segment

The mid-segment market is anticipated to be the most dynamic, catering to a broad spectrum of buyers including young professionals and families. These properties offer functional living spaces at competitive prices, supported by increasing demand and evolving lifestyle preferences.

3. Budget Segment

While the budget segment may experience incremental price increases, the overall growth rate is expected to be more subdued compared to other segments. Factors such as rising construction costs and sustained demand for affordable housing contribute to this segment's modest growth outlook.

Investment Strategies: Long-Term vs. Short-Term

1. Long-Term Investment

Investors seeking capital appreciation should consider luxury and mid-segment properties in developing sectors poised for significant infrastructure development. These areas offer potential for substantial growth over a 5-10 year horizon, driven by urbanization trends and enhanced connectivity.

2. Short-Term Investment

For investors focused on rental income, budget and mid-segment properties in high-demand areas present attractive opportunities. These properties generate quicker returns through rental yields, although capital appreciation may be more gradual compared to higher-end segments.

Additional Considerations

1. Rental Yields

Assessing potential rental yields is crucial for investors evaluating property investments in Gurgaon. Budget and mid-segment properties typically offer higher rental yields compared to luxury properties, aligning with the demand for affordable rental housing in the city.

2. Exit Strategies

Developing a clear exit strategy is essential for optimizing investment returns. Understanding market dynamics and identifying the target buyer profile or rental market can guide effective property disposal decisions over time.

3. Tax Implications

Investors should be aware of tax implications associated with property transactions, including acquisition, ownership, and eventual sale. Consulting with a tax advisor ensures compliance with local regulations and maximization of tax benefits where applicable.

Conclusion

Gurgaon's residential property market in 2024 presents promising opportunities for investors seeking to capitalize on the city's economic growth and evolving urban landscape. By navigating factors such as location dynamics, property types, amenities, infrastructure developments, and investment timelines, stakeholders can make informed decisions aligned with their financial objectives. Whether aiming for long-term capital appreciation or immediate rental income, strategic planning and market insights are crucial for success in Gurgaon's dynamic real estate environment.