Real estate has long been a favored avenue for wealth creation, providing both short-term and long-term returns for investors. As we enter 2025, the real estate landscape is evolving rapidly, presenting new opportunities for those looking to secure their financial futures. The dynamics of the market, combined with shifts in global economic conditions and technological advancements, make now the ideal time to invest in real estate.

In this article, we will explore why 2025 is a key year for Real Estate Investment, the latest trends and opportunities, and the strategies you should adopt to maximize your returns. If you're ready to take advantage of the promising opportunities in real estate this year, read on to discover valuable insights and actionable tips for success.

Table of Contents:

-

Introduction: Real Estate Investment in 2025 – A Promising Outlook

-

Top Reasons Why 2025 is the Year to Invest in Real Estate

-

2.1 Economic Recovery and Growth

-

2.2 Rising Demand for Housing

-

2.3 Attractive Financing Options

-

2.4 The Rise of Remote Work and Suburban Shifts

-

2.5 Sustainability and Green Building Trends

-

-

Trends to Watch in 2025: What’s Shaping the Real Estate Market?

-

3.1 Smart Home Technology and Automation

-

3.2 Growing Popularity of Hybrid Workspaces

-

3.3 Urbanization and Infrastructure Development

-

-

Tips for Real Estate Investment Success in 2025

-

4.1 Focus on Prime Locations

-

4.2 Leverage Technology for Smarter Investments

-

4.3 Diversify Your Investment Portfolio

-

4.4 Stay Informed About Local Market Trends

-

4.5 Consider Sustainable Investments

-

-

Challenges and Considerations in Real Estate Investment

-

Conclusion: Invest in Real Estate Today for Long-Term Success

1. Introduction: Real Estate Investment in 2025 – A Promising Outlook

Real estate remains one of the most reliable investment options, and 2025 presents a unique opportunity for investors. While real estate markets can be cyclical, the combination of economic recovery, technological advancements, and shifting housing demands makes this an ideal time to invest.

Over the past few years, the real estate market has seen considerable volatility due to the global pandemic and economic uncertainties. However, as economies bounce back and housing needs evolve, 2025 offers an environment conducive to lucrative real estate investments.

2. Top Reasons Why 2025 is the Year to Invest in Real Estate

2.1 Economic Recovery and Growth

The global economy has experienced significant disruptions over the past few years. However, the outlook for 2025 is much brighter, with economies recovering from the pandemic and showing signs of steady growth. As businesses regain their footing and consumer confidence improves, the demand for real estate is poised to increase.

In particular, the real estate market in developing regions and high-demand cities is expected to grow as more people seek stable investments. The increasing availability of jobs, a stronger middle class, and growth in disposable income will drive demand for residential, commercial, and rental properties.

2.2 Rising Demand for Housing

As the global population continues to grow, the demand for housing is skyrocketing. By 2025, more people will need affordable, quality housing in both urban and suburban areas. This demand is driven by an expanding global population, particularly in countries like India, where urbanization is rapidly taking place.

The supply of housing in many regions is not keeping up with the demand, making real estate an attractive investment option. Investors can capitalize on this trend by purchasing properties in high-demand locations, offering both long-term appreciation and rental income.

2.3 Attractive Financing Options

The real estate market in 2025 benefits from historically low interest rates, making financing more affordable for investors. This presents a unique opportunity for investors to leverage their capital and acquire properties with lower borrowing costs. With the right financing options, investors can enjoy increased cash flow and higher returns.

Moreover, governments in several regions are offering incentives for real estate investments, particularly in areas related to sustainability and affordable housing. These incentives can further reduce the initial investment burden and make real estate even more attractive in 2025.

2.4 The Rise of Remote Work and Suburban Shifts

The rise of remote work, accelerated by the global pandemic, has significantly changed housing preferences. Many workers now prefer homes in suburban and rural areas, where they can enjoy more space and a quieter environment, at a lower cost than in major urban centers.

This shift presents an opportunity for real estate investors to focus on suburban areas and smaller cities, which are seeing increased demand for housing. Investors who identify and purchase properties in these emerging areas can benefit from both long-term capital appreciation and strong rental yields as more people move to the suburbs for work-life balance.

2.5 Sustainability and Green Building Trends

As environmental concerns grow, there is an increasing demand for sustainable, energy-efficient homes and commercial properties. Green buildings are not only attractive to eco-conscious buyers and tenants but can also command premium prices and rental rates.

In 2025, investors who prioritize energy-efficient properties or green building certifications (such as LEED) will benefit from higher returns. Additionally, governments are providing incentives for sustainable building projects, further boosting the appeal of green real estate investment.

3. Trends to Watch in 2025: What’s Shaping the Real Estate Market?

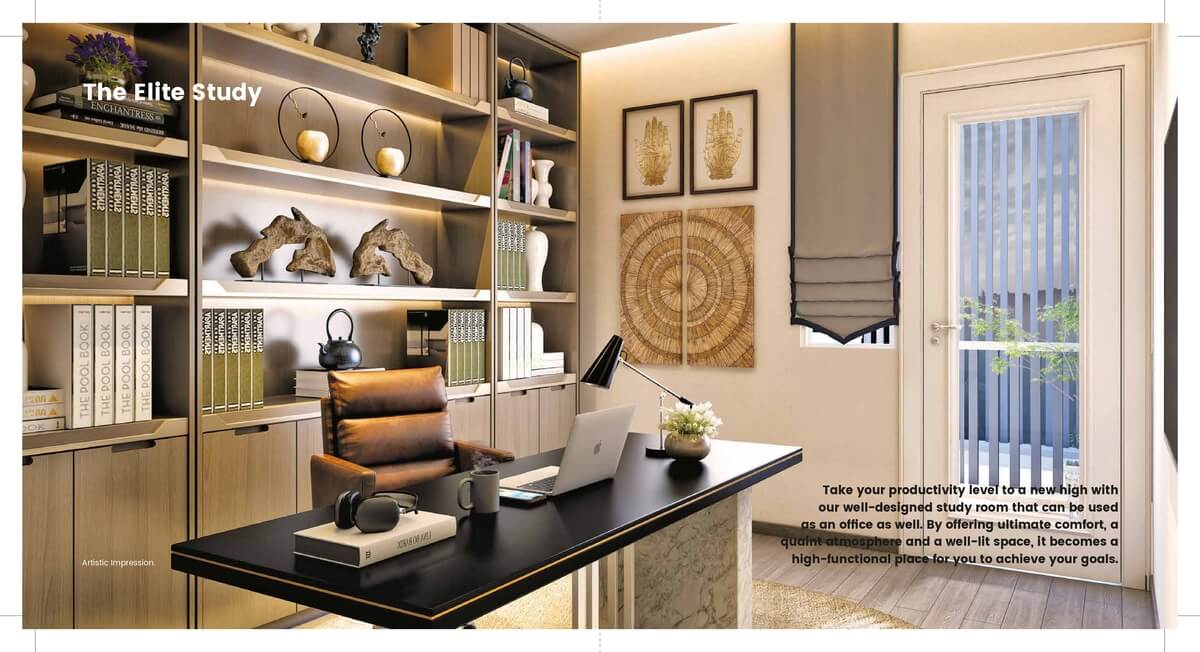

3.1 Smart Home Technology and Automation

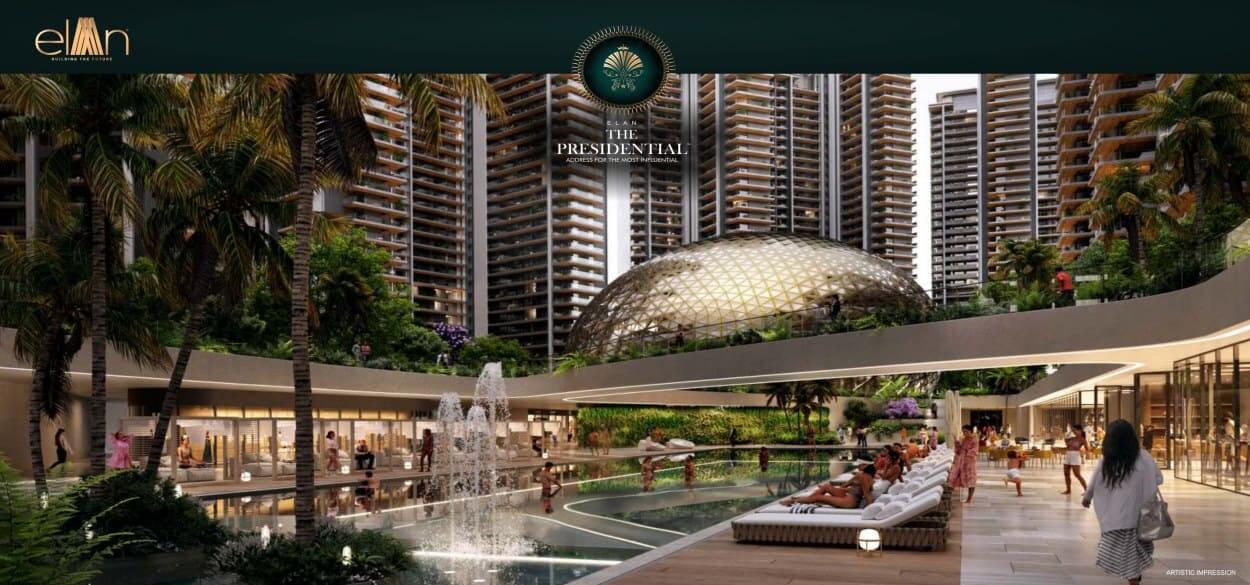

Technology is revolutionizing the way we live and work, and the real estate market is no exception. Smart home technology, such as automated lighting, temperature control, and advanced security systems, is becoming a key feature for modern homes. These technologies make properties more convenient, efficient, and secure, driving up demand.

Investors who incorporate smart home features into their properties can attract higher-paying tenants and buyers who prioritize technology-driven living spaces. This trend will continue to grow in 2025 as consumers demand more connectivity and convenience.

3.2 Growing Popularity of Hybrid Workspaces

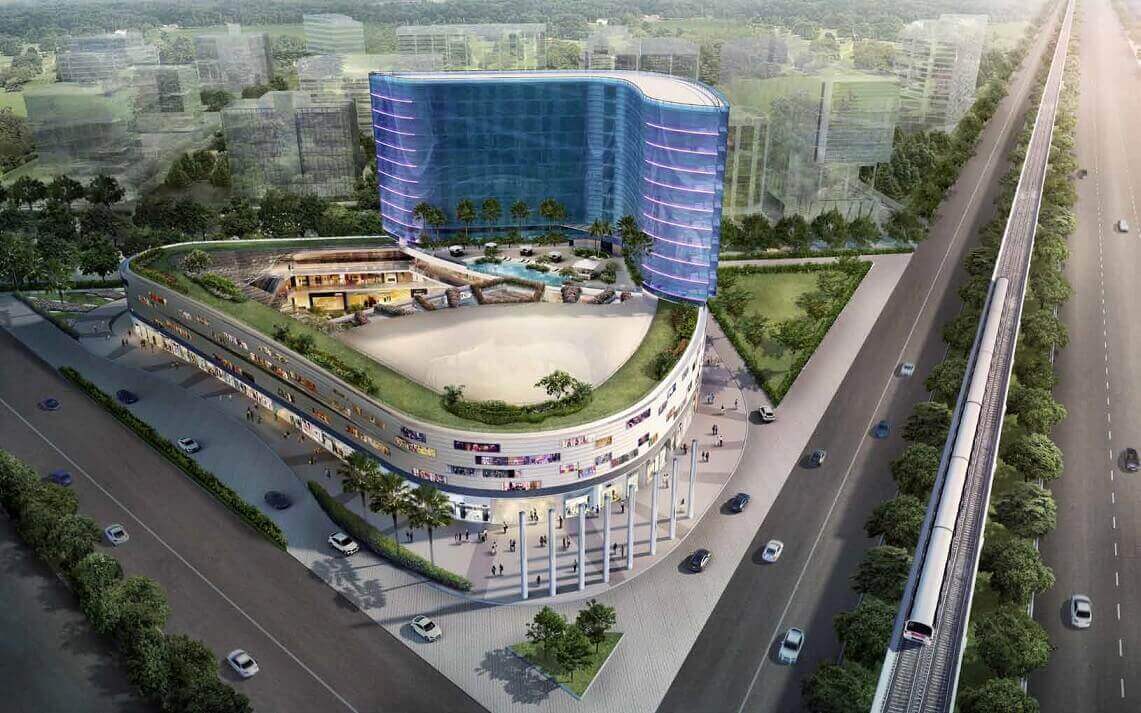

Hybrid workspaces, a combination of remote and in-office work, are becoming a prominent trend in commercial real estate. As businesses embrace flexible working models, there is an increased need for commercial properties that cater to hybrid work environments, such as coworking spaces and flexible office solutions.

For real estate investors, this trend presents an opportunity to invest in commercial spaces that can be adapted for hybrid working. Properties with flexible layouts and modern amenities will be in high demand, especially in cities that serve as business hubs.

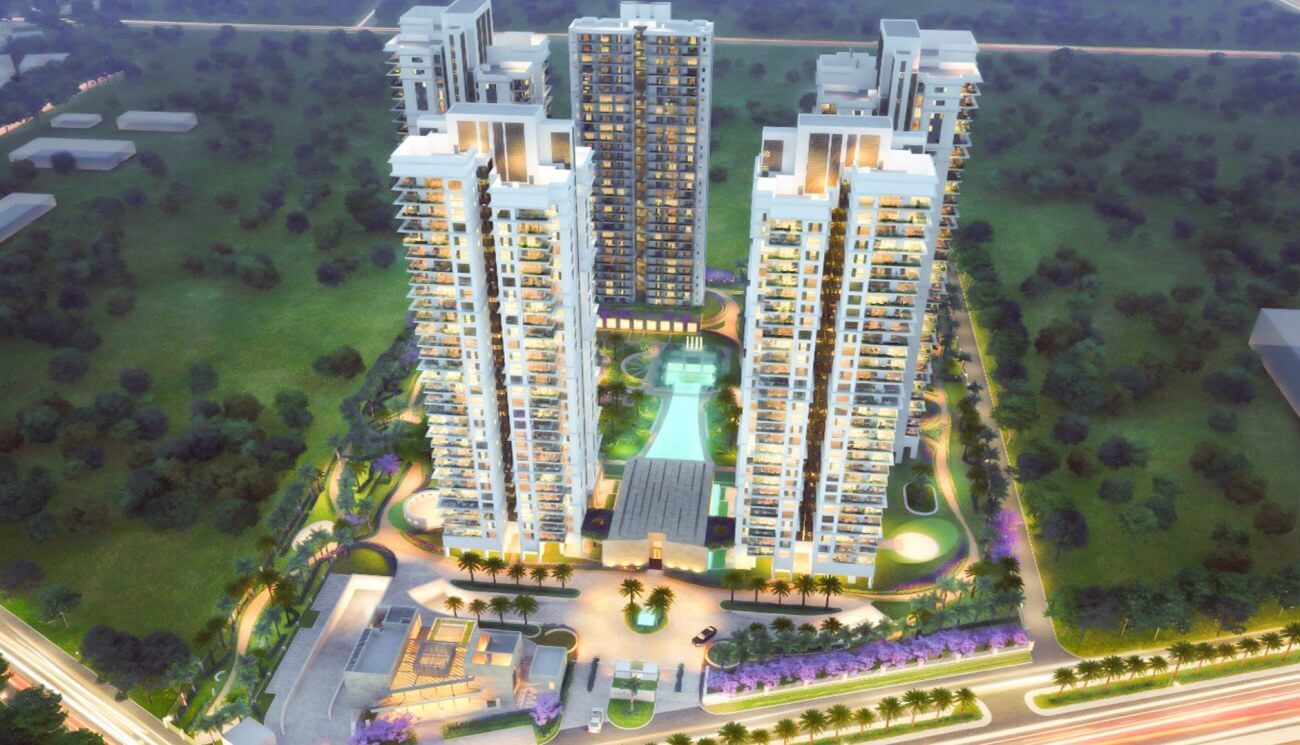

3.3 Urbanization and Infrastructure Development

Urbanization continues to be a major trend, particularly in developing countries where millions of people are moving to cities in search of better opportunities. The expansion of infrastructure, including roads, transportation systems, and utilities, is driving the demand for Real Estate in urban areas.

Investors should keep an eye on cities undergoing significant infrastructure development. By investing early in these areas, they can benefit from long-term growth as the area becomes more accessible and desirable.

4. Tips for Real Estate Investment Success in 2025

4.1 Focus on Prime Locations

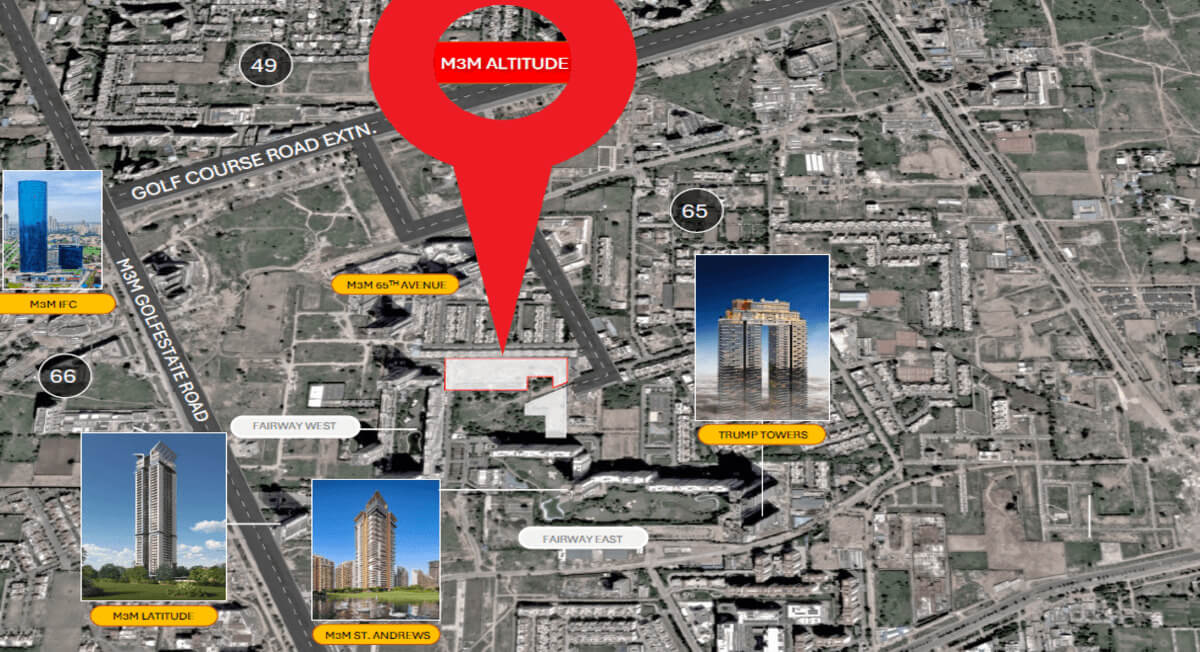

Location has always been the most crucial factor in real estate investment success, and it remains a top priority in 2025. Focus on areas with high growth potential, such as emerging suburban markets, tech hubs, or cities undergoing infrastructure development. These regions are more likely to experience significant appreciation in property values, offering lucrative returns.

4.2 Leverage Technology for Smarter Investments

In 2025, technology plays a pivotal role in making real estate investment decisions. Tools like property analysis software, virtual property tours, and AI-driven insights can help you make smarter investment choices. By leveraging technology, you can quickly identify high-growth areas, predict future trends, and assess the financial viability of properties.

4.3 Diversify Your Investment Portfolio

Diversification is key to minimizing risk and maximizing returns. Don’t put all your eggs in one basket; instead, invest in a variety of property types, such as residential, commercial, and industrial properties. Additionally, consider diversifying across different geographical regions to reduce the risk of market fluctuations in one specific area.

4.4 Stay Informed About Local Market Trends

To succeed in Real Estate Investment, you need to stay informed about the latest market trends. Research local economies, job growth rates, and housing demands in the areas you’re considering for investment. Understanding these trends will help you make informed decisions and avoid purchasing properties in markets that may face economic challenges.

4.5 Consider Sustainable Investments

Sustainability is not just a trend but a growing movement in the real estate industry. As consumers become more eco-conscious, investing in sustainable properties can yield higher returns in the long run. Consider properties with green certifications, energy-efficient features, and low environmental impact when making investment decisions.

5. Challenges and Considerations in Real Estate Investment

While real estate investment can be highly profitable, it’s important to be aware of potential challenges. These include market fluctuations, interest rate changes, and property management costs. Additionally, unexpected maintenance or renovation expenses can impact your profitability.

To mitigate these risks, make sure you conduct thorough due diligence before making an investment, and be prepared for the long-term commitment that real estate investment requires. Having an emergency fund and contingency plans in place will help you navigate any unforeseen challenges.

6. Conclusion: Invest in Real Estate Today for Long-Term Success

2025 offers a wealth of opportunities for real estate investors, from the economic recovery and rising housing demand to emerging trends like smart homes and sustainability. By staying informed about market conditions, leveraging technology, and diversifying your investment portfolio, you can position yourself for success in the coming years.

Don’t miss out on this opportunity! Act now and schedule a site visit today by reaching out to us:

-

Phone: +91 99999 64462

-

Email: info@reiasindia.com

-

Website: Reias India Real Estate Private Limited

-

Office Address: R-2131, M3M Cosmopolitan, Sector 66, Gurgaon

Invest smartly, invest in real estate, and secure your future today!